Entrepreneur Tarek Kamil has a simple rule of thumb for success with a startup business: Do not die. More than 20 years ago, he launched WhatIf Sports, an online fantasy sports game that grew out of a hobby. He sold it to Fox Interactive in 2005. Years later, as a member of the Madeira school board, he developed a communication platform to help parents and educators better engage with students. That evolved into a product called Broadcast, the main offering of his latest company, Cerkl.

“It was never meant to be a business,” says Kamil. “I built it in my free time.”

What started as a pastime has grown rapidly, and now large companies subscribe to the Broadcast platform as a means for more effectively communicating with employees. Cerkl started with Kamil as the lone employee; it didn’t die, and now it employs about 50 people. At the start of 2022, the company announced plans to add another 125 jobs, representing a total of $9.45 million in payroll, over three years.

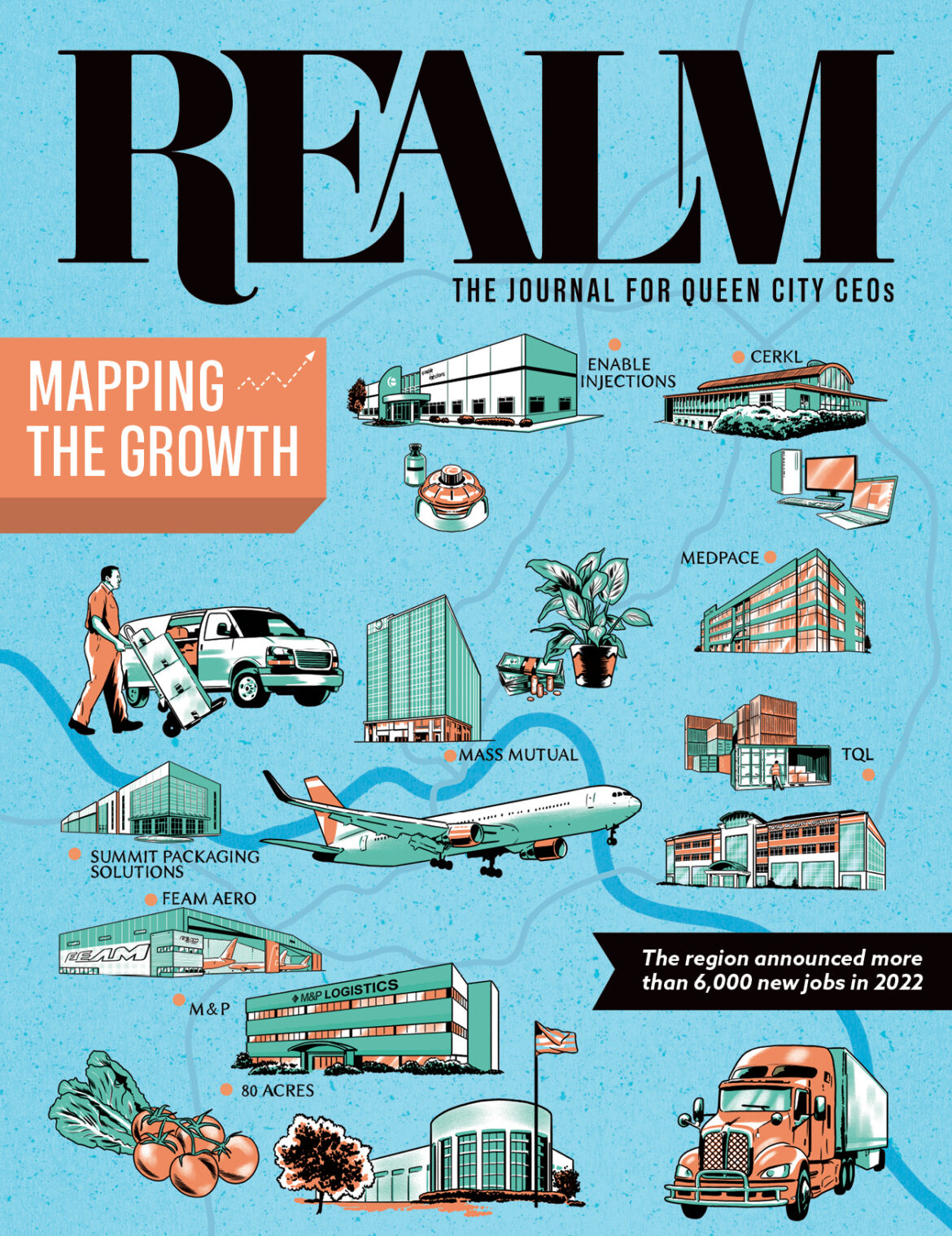

That major expansion of the Blue Ash-based startup was the Cincinnati region’s first big job growth announcement in a year that saw homegrown businesses make plans to add thousands of new jobs supported by tens of millions of dollars in investments. In fact, businesses announced plans to add nearly 6,000 jobs in the 16-county tristate region, according to REDI Cincinnati and Northern Kentucky Tri-ED, the area’s two main economic development organizations. “It’s definitely been a banner year,” says REDI Cincinnati CEO Kimm Lauterbach.

The year ended with the biggest announcement in all of 2022, a plan revealed in late December by Medpace to add 1,500 employees and $90 million in payroll over six years at its headquarters campus in Madisonville. The growing company provides clinical research to pharmaceutical companies developing new drugs and now has operations in 40 countries. The company said it plans to hire for a variety of roles in Cincinnati, including physicians, lab technicians, clinical research associates, data analysts, financial analysts, and software engineers.

Medpace also said it’s committing to invest $150 million to expand its Cincinnati headquarters by constructing a new building expected to hold 250,000 square feet of office space along with a parking garage for 1,000 vehicles. The infrastructure investment will allow Medpace to grow its employment in Ohio by nearly 80 percent, the company says.

The health care and life sciences sector has been a significant factor in the region’s job growth in recent years. From 2017 to 2021, the region saw nearly 25 percent growth in jobs in the biohealth sector, says Lauterbach. “We’ve proven that this is a growing place for the life sciences industry, and that’s really impactful for us.”

A total of 2,356 new jobs in Northern Kentucky were announced in 2022, says Lee Crume, CEO of Tri-ED (now BE NKY), and they’ll pay an average wage of just over $66,000. Those new projects reflect nearly $300 million in capital investment. All of those metrics exceeded Tri-ED’s goals for the year.

The year continued the growth in the local economy that began in the latter half of 2020 and continued in 2021. “We came into the year with a lot of momentum, with good results having been posted, and with a good project pipeline,” says Crume.

In Northern Kentucky, 2022 began with the announcement that 80 Acres—the Hamilton, Ohio-based indoor fruit and vegetable growing operation—plans to open an under-roof, vertical farming facility in Boone County that could eventually employ 125 people. The operation will be a high-tech, controlled-environment vertical farm to host the harvesting, packaging, and distributing of leafy greens, microgreens, berries, and tomatoes. It will have the capacity to grow millions of servings of local, fresh produce for the region. “This farm is the biggest step forward for us yet, more than doubling our total production, and growing our footprint outside Ohio,” says 80 Acres CEO Mike Zelkind.

For the most part, new investments and job growth in the region came from companies such as Medpace, Cerkl, and 80 Acres, enterprises already located here that decided to stay and expand. There may be no better example of that than Total Quality Logistics, which launched in 1997 and has grown into an $8 billion operation that employs 9,000 people in 56 locations across the U.S.

In March, TQL announced its third expansion since 2019 at its Clermont County headquarters. The freight brokerage company connects its customers (manufacturers that have products to ship and distribute) with freight carriers across the country who can do the job. Already growing steadily since its founding, business exploded in 2021 with the pandemic-fueled increase in e-commerce. Its employee headcount grew 49 percent in 2021 alone.

The company revealed plans in March to add another 1,000 jobs at its headquarters, amounting to an estimated $60 million increase in its annual payroll. In addition to new jobs, TQL said it plans to substantially expand its real estate footprint with an $18 million investment at its Ivy Pointe headquarters campus in Clermont County’s Union Township. “They just continue to knock it out of the park in terms of their growth and their success,” says Lauterbach.

Enable Injections is another homegrown company, a life sciences startup that launched in 2010 as a portfolio company of CincyTech, the public-private venture investor. Enable is developing wearable drug delivery systems for a range of therapies and diseases, devices meant to reduce the need for intravenous drug administration. In March, it committed to adding 257 jobs over the next five years, with an estimated additional payroll of $19.9 million.

“That’s a critical example of finding that unicorn startup that the Cincinnati region embraced,” says Lauterbach. “We feel it cements the Cincinnati region as their forever home, hopefully, and is another great example of how we’re working from startup all the way to scale at these technology companies.”

The acquisition of a local company can often mean the closure or relocation of the home office. In May 2021, American Financial Group’s life insurance unit, Great American Life Insurance, was acquired by Massachusetts Mutual Life Insurance Co. in a $3.5 billion deal. The 600 employees of Great American Life may have worried about their future, but in March MassMutual committed to not only preserving those 600 here but adding 150 jobs by the end of 2026.

The Springfield, Mass.-based financial company also said it would invest $8 million to build out office space in the GE Global Operations Center at The Banks and move most of the former Great American workers there. The Great American Life brand will be changed to MassMutual Ascend, a name that may soon become more familiar as it’s expected to be affixed to the exterior of the 12-story GE Center.

The expansion of an office project in the central business district was good news in the new pandemic reality of remote and hybrid work, Lauterbach says. “That’s a testimony to the diversity of our economy.”

The region’s economic vibrancy was also endorsed in November when British Airways announced it would begin a new direct route from CVG to London Heathrow beginning in summer 2023. It will be the second direct flight from Cincinnati to Europe, after Delta’s nonstop to Paris.

“This announcement puts us on stage to recruit companies that we wouldn’t have had conversations with,” says Lauterbach. “It’s definitely a validation of the market.”

For Kamil and his Cerkl startup, Cincinnati’s regional economy was the only one to consider when it came to time to expand. “I will never leave,” he says. “There’s no reason for us to go anywhere else.”

One of his biggest reasons for staying here is the relatively low cost of doing business. Another is the supply of tech talent, not just from the University of Cincinnati but from other colleges in the broader region such as Ohio State, the University of Dayton, and Purdue University, all with reputable engineering schools. “There’s so much talent here that people don’t talk about,” says Kamil.

Then there is the number of big companies in Ohio: 25 companies on the Fortune 500, ranging from Kroger and Procter & Gamble to Progressive Insurance and Goodyear. They each employ tens of thousands of people, making them prime candidates for Cerkl’s internal employee communications platform.

Kamil also notes the region’s “Midwest mentality” as a plus in making business connections. “It’s easy to get introduced to the right people,” he says. “I don’t think there’s anywhere better in the world to create business-to-business software.”

Many startups fizzle before they can figure out the right product fit for the right markets, he says, partly due to the expense of doing business. That risk is lower here due to manageable costs, strong talent, and big companies. “When you’re building a business, the number one key to success is Do not die,” says Kamil. “People assume startups just explode. But that’s not in line with reality. The reality is Do not die. When you find your product fit, that’s when it’s time to accelerate.”

The past year was focused on sales and marketing and renewing customers, he says, and over the next six months he expects Cerkl to reach revenue milestones that will trigger the new hiring he’s planning.

In Those two projects have already provided something of a ripple effect, putting the state on the radar as a center of advanced manufacturing. “Ohio has really skyrocketed on to the high-tech map,” says Lauterbach.

The growth of electric vehicle battery manufacturing, in particular, should present opportunities for this region. In Kentucky, Ford is building two lithium-ion battery plants in Hardin County, and Envision AESC, a Nissan joint venture, plans to build a plant in Bowling Green. “Imagine what that supply chain opportunity looks like from southern Kentucky up through just south of Columbus,” says Lauterbach. “We have a rich automotive history, so I think the opportunity for us is pretty massive for the foreseeable future.”

The evolving dynamics of the nation’s supply chain and this region’s role as a key link in the chain are driving new jobs and investment in Northern Kentucky, too. “It’s been a really strong year in the logistics space and where industries intersect with logistics,” says BE NKY’s Crume.

In March, F&E Aircraft Maintenance (FEAM Aero) said it would expand at the Cincinnati/Northern Kentucky International Airport, where it already employs about 300 people. It plans to create nearly 250 full-time positions and invest $40.2 million to build a three-bay hangar, large enough to house Boeing 767 aircraft, to support the airport’s growingcargo operations led by Amazon and DHL. “Those are fantastic, good-paying trade jobs,” says Crume.

The performance-based incentive agreement with the state of Kentucky calls for FEAM to pay an average hourly wage of $38.50, including benefits, to its new workers.

In August, local officials celebrated the opening of Summit Packaging Solutions’ operation in Boone County, the result of an $18.2 million investment the company says will create 254 new jobs. Summit is a major cog in the nation’s supply chain, providing custom packaging for products and brands owned by Fortune 500 companies. It’s a minority-owned business led by Adam Walker, whose resume includes five seasons as an NFL running back in the mid-1990s.

Also in August, Mackenzie and Paige Logistics, which now employs 30 people in Boone County, announced aggressive growth plans to invest nearly $4 million and create 210 full-time jobs over 10 years. The company plans a new headquarters operation in Florence to employ people in sales, operations, administrative, and management roles. During the year, M&P Logistics made the Inc. 5000 list of the fastest-growing companies in the country, with 84 percent growth over three years.

Another fast-growing logistics firm, BM2 Freight Services, said in September it will expand its offices in Tower One of Covington’s RiverCenter complex with a $2.3 million investment that’s expected to lead to 56 additional jobs.

In addition to the rapid growth at its Clermont County headquarters, freight broker TQL is growing in Kentucky as well. It announced plans in February to add 525 jobs over 10 years in the commonwealth, including 125 at its operation in Boone County.

New Northern Kentucky projects included the plans of life sciences company Thermo Fisher Scientific to create 200 full-time jobs as part of a $59 million expansion of the company’s clinical research lab in Highland Heights. Nearly 650 people are already employed at the site, where they handle clinical testing of pharmaceuticals.

Also in the life sciences sector, the Kentucky General Assembly agreed to direct $15 million to the creation of a shared research and development lab proposed by several Covington-based biotech companies. Bexion Pharmaceuticals, Gravity Diagnostics, and CTI Clinical Trial and Consulting Services say it will accelerate their own growth and the growth of the industry overall in Northern Kentucky. “That’s a fantastic economic development win for the community,” says Crume.

The Boone County expansion for 80 Acres comes from a company that’s combined agriculture and high-tech, growing fruits, vegetables, and herbs indoors in controlled environments that require less water than outdoors and aren’t susceptible to the whims of Midwest weather. It built its first indoor farm inside the old Miami Motor Car Co. building in Hamilton, Ohio, beginning operations there in 2021.

The business has been operating at capacity, with packaged mixes of greens and cherry tomatoes sold in Kroger and Whole Foods stores and carried by major food distributors. When it looked to expand outside of Ohio, it settled on a site in Florence, an existing building that was once the home of a printing plant. “We grow to meet demand,” says Tim Dwyer, vice president of engineering and real estate for 80 Acres. “We’re trying to expand responsibly, and we thought the Northern Kentucky area would be a great place for us. It’s about an hour from our headquarters, and it will allow us to push south into other markets.”

The Florence farm will put the company’s produce closer to consumers in Lexington and Louisville, and at 200,000 square feet it will ultimately be nearly three times the size of the Hamilton farm. 80 Acres products are available across Ohio, Indiana, and Kentucky, and the company recently entered the Nashville market.

Part of its sustainability philosophy is to adapt existing facilities for reuse when possible. The Florence facility fit the bill in terms of its footprint, the ability to reconfigure the interior as needed, and its existing utility infrastructure, Dwyer says. The good fit was fortunate, as the cost of building new was rising and the prospect of supply shortages meant the possibility of construction being delayed. “This building very quickly started to check all the boxes we needed,” says Dwyer. “This farm is going to be much, much larger and will include all of our learnings from the original farm. It’s also going to include all of the R&D that we’ve been working on over the last two years.”

The farm’s first zone is in operation now, growing basil. The next zones will grow leafy greens. The farm is being built out in modular fashion, with each zone able to be adapted to different plants by changing the lighting and the climate, says Dwyer.

The region’s 2022 job wins provide momentum going into a year that economic development experts say will be hard to predict. Rising interest rates, the volatility of energy costs, and a war in Europe loom as the big intangibles in the economic period ahead. “There are lots of moving pieces that make it hard to predict what the next six to nine months will look like,” says Crume.

Chief among those is the Federal Reserve’s ongoing interest rate increases. “You’re seeing people trying to make deals work with much higher interest rates than we’ve seen in recent times,” he says. “Things are just moving slower as a result.”

Lauterbach says she’s seeing the same effect. “We have more than $2 billion worth of capital investment projects in our pipeline, but we’re hearing companies say, We’re going to just hold on this decision and give ourselves six months, eight months. We want to see where we’re going to end up in this economic environment.”

As Cerkl’s Kamil notes, the low cost of doing business in the Cincinnati and Northern Kentucky region will remain a benefit through any period of uncertainty. “We have a really affordable location,” says Lauterbach. “So as companies are looking at costs rising all over, we’re going to have a more affordable option here in the Midwest. I think that continues to give us an advantage.