Real estate trends come and go, buffeted by interest rates, changing consumer tastes, and macroeconomic realities. And then, once in a generation perhaps, a global pandemic appears out of nowhere and turns everything upside down.

Adaptive reuse has always been a key tool for Cincinnati developers, given the city’s extensive collection of intact historic buildings. Pre-pandemic, the urban core saw a wave of underutilized office buildings converted to boutique hotels: Renaissance Hotel, Kinley, Hotel Covington, and others. Most of the housing units added downtown, though, were new construction, from 1010 on the Rhine above the Kroger store and The Blonde to Fourth & Race and Ovation in Newport. Until the pandemic, that is, when previously bustling office buildings emptied out and—in a disruption no one really saw coming—had to deal with an exploding work-from-home movement even after COVID was tamed.

Developers have picked up the pace of converting corner offices into loft condos and apartments in recent years, transforming downtown Cincinnati and nearby areas with more residential units that feed the region’s need for new housing to support population growth. (See our interview with Mayor Aftab Pureval for city government’s role in this housing push.)

National real estate giant CBRE studied the office-to-residential trend in a November 2024 report that showed Cincinnati as the No. 2 U.S. city in converting office space to housing as a percentage of total office inventory. More than 9 percent of Cincinnati’s office inventory was in the process of being converted to housing at that point, compared to the overall national conversion rate of 1.7 percent.

RentCafe followed up with a report in spring 2025 listing Cincinnati as the nation’s No. 9 city with 1,753 office-to-housing units in the pipeline. New York, Los Angeles, Chicago, Dallas, Atlanta, Minneapolis, Charlotte, and Washington, D.C. were the only cities working on more conversions.

To be fair, a number of local projects were underway or announced before the pandemic—though the post-pandemic period has demonstrated consumer demand for new downtown housing and jumpstarted this redevelopment push. And the trend includes other types of conversions as well, such as Factory 52, the former site of the U.S. Playing Card factory in Norwood.

The movement has continued to gain momentum here, with recent announcements on funding and initial plans for repurposing the Carew Tower and Atrium 1 office towers downtown as residential housing. Let’s look at a few recent successful conversion projects.

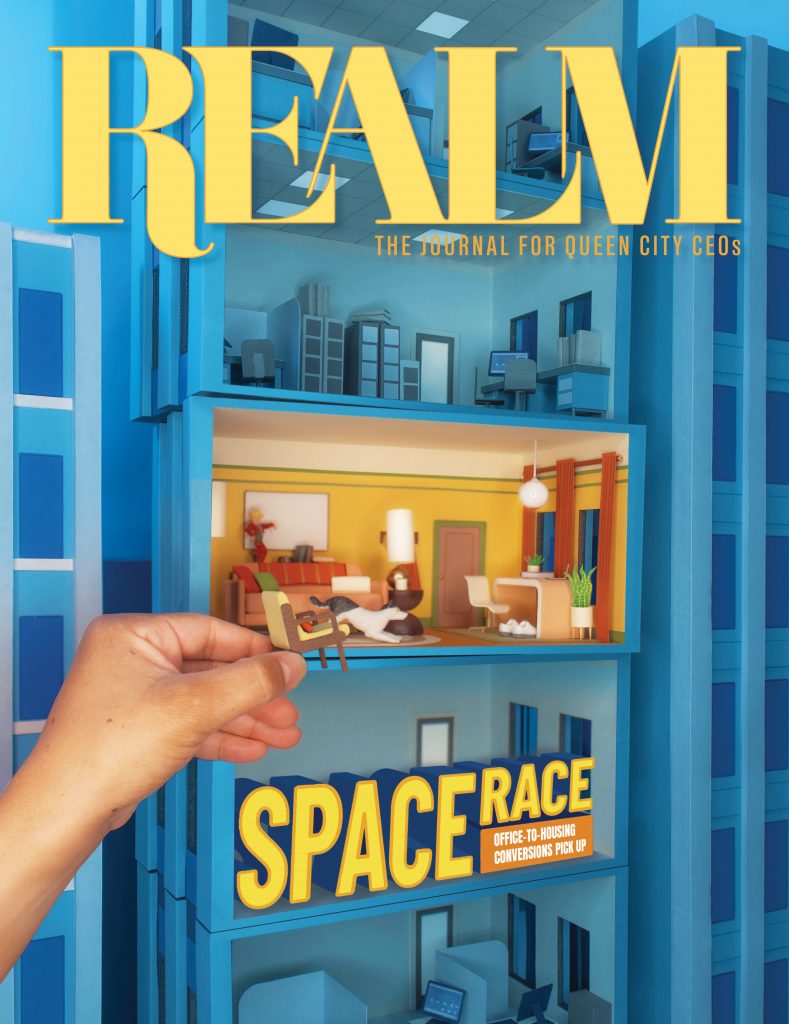

[Paper art by Jeff Hinchee]

Upgrading the Mercantile Building

When conversion is possible, it’s an exciting time of potential. And when the conversion is complete? New residents and the local economy benefit, certainly, but so do the developers themselves. Take the Mercantile Building, for example.

“You have to have an office that doesn’t work as an office any more,” says Bobby Maly, chief executive officer of real estate developer Model Group. “There are a number of reasons why, like maybe the owner hasn’t invested enough money in it to keep tenants. But that’s what happened with the Mercantile Building.”

Model Group purchased the Mercantile Building, the Formica Building next door, and the Mercantile Center in 2021. The previous owner had already vacated existing office tenants in the Mercantile, and then the Formica businesses also left—and suddenly an opportunity for largescale redevelopment presented itself half a block from Fountain Square.

When these kinds of vacancies occur in older office buildings, developers and owners face a choice: Reinvest and fill the building back up with tenants or move into the residential game. “The office market has really changed, and so if you can’t bring in new tenants, it might be a candidate for conversion,” says Maly. “The big, square floor-plate buildings are not ideal for residential because they have dark centers and people want to live with windows, and we sometimes have these awkward unit sizes. The Formica Building and Mercantile Building were rectangles, so we felt really good about residential conversions.”

To be an ideal candidate for residential conversion, two crucial criteria must exist. First, the building needs existing vacancy or the ability to relocate commercial tenants. Second is the shape, as Maly explains. Rectangular-shaped buildings are inherently better candidates than square-shaped buildings for residential conversion.

With office buildings, the clincher for conversion comes down to the floor plate, which is developer-ese for the total square footage of leasable space on any given floor. In square-shaped buildings, the floor plate is typically larger and wider—a challenge for converting offices into liveable spaces. “With a rectangular building, you can have a double-loaded corridor with the right size units featuring light and windows for the tenants, versus big squares with really big office plates,” says Maly. “You have units on the outside, but it leaves you with either really long, narrow unit sizes and awkward spacing or dark, dark centers, where people tend not to want to live.”

The Mercantile apartments opened in earlier this year with a total of 172 residential units. The smallest unit studio clocks in at 473 square feet, and the largest units, two penthouses, are 1,936 and 1,845 square feet. A full gym, indoor pet run, and rooftop lounge are just some of the amenities designed to take advantage of the space and tempt more renters to live downtown. And, of course, construction work allowed the Mercantile Library to expand to two full floors.

Model Group’s next office-to-residential conversion project is a partnership with Vermont-based developer Acabay Inc. to convert up to 12 floors of the Atrium 1 building on Fourth Street into apartments.

Working Around the Challenges

Nearly 6,000 people live within downtown proper, according to the 2020 U.S. Census, and roughly 88,000 work downtown, according to the Cincinnati Regional Chamber. According to the 2025 RentCafe report, almost 12 million square feet of downtown office space here is “suitable for future transformations.”

Many local and national developers agree. The former Macy’s office headquarters on Seventh Street, vacant since 2020, was purchased by Victrix LLC, a development group out of New York City, and turned into 341 luxury apartment units. Now called 7 West 7th, the apartment building officially opened in April. Victrix is also behind the planned conversion of Carew Tower offices into apartments, a project that’s been on the horizon for some time.

Beyond the constraints of a floor plate, developers need to consider other spaces where residents spend time, like the kitchen or the restroom, both of which have specific plumbing needs. Any office building will present its own set of unique challenges.

“We really enjoy that kind of complex problem-solving and finding these opportunities to work with existing buildings, even though they can be really challenging,” says Amanda Markovic, principal and market design leader for mixed-use with GBBN Architecture. “It is such an important aspect of the fabric of our communities.”

GBBN worked with Detroit-based City Club Apartments on converting the Union Central Trust Building downtown into 294 apartment units. The former office building was built in 1928, two years before Carew Tower, and the apartment building opened in 2018.

“Taking an office and converting it to residential has inherent complexity to it around all of the systems,” says Markovic. “Typically in a commercial and office building you have your core that runs up the center of the building holding all the restrooms for offices. Getting plumbing out to the further expanses of the building is where that gets challenging. It means being very strategic and utilizing that vertical core to get to each floor with the main services and then branching out from there, but not reducing overall ceiling heights. So the corridors may get a little bit shorter, but then we want to keep the apartment units open. It’s really about being strategic about how you’re laying out spaces and units.”

Residential spaces have different building codes from office buildings. For City Club, the developers and GBBN had to accommodate both code requirements and historical preservation requirements. There was a single staircase that went all the way up the building, for instance, which didn’t meet code. “We always need two stairways for a building with higher occupancy,” says Markovic. “We looked at adding a stair, but that would have reduced the overall unit count pretty significantly. So what we did—per code, but it hadn’t been done in Ohio before—is design an emergency egress elevator.”

It utilized one of the building’s former elevator shafts and resulted in another part of the existing structure being preserved. “Getting residents out of the building is different from getting people in office or commercial spaces out of the building,” says Markovic. “There are different code requirements, so that’s always the first thing we look at in these older buildings.”

Next door to City Club is the PNC Tower, an apartment conversion now called Sky Central. The former office building remains under construction but will soon add 294 market-rate units. Conversion of the former Pogue’s Department Store building on Race Street by ABC Realty Advisors was announced in 2024 and will add 122 apartments designated as affordable housing, not market-rate, a rare move for downtown real estate.

A Fun Factory

PLK Communities purchased the former U.S. Playing Card factory after it had been vacant for more than a decade and transformed it into Factory 52, a residential and mixed-use center in Norwood. The company has grown into the largest owner of multifamily housing units in the Cincinnati region over the past 25 years.

“I think just about everybody in town looked at that Norwood site and was looking at it from, How do we restore and rehabilitate the whole thing? And it just didn’t work,” says Nick Lingenfelter, chief development officer of PLK. “We found the only way we could do it is if the city approved us demolishing a significant amount of the structures there in order to make the project economics work.”

Two of the former factory’s most iconic landmarks were the grand old brick clock tower at the front of the complex and a tall smokestack. PLK and MSA Architects knew the community considered these visual touchpoints as important to preserve.

“We thought we could actually incorporate them into the new design,” says Lingenfelter. “When you’re walking the site, one of the things I wanted to do was leave the character and leave the flaws, because so many times when you redevelop an older building it ends up looking brand new when you’re finished. And that’s not really what we want to do. We want the things that people touch the most to be those character points.”

Two other original structures were preserved on the 20.6-acre site: the factory building and the shipping facility. The latter became the public food hall, Gatherall. Residential residential space are similar to those of an office building; the floor plate is critical to the conversion success here as well.

“The thing people don’t realize is you don’t typically want a unit more than 35 or 40 feet deep,” says Lingenfelter. “When all of your windows are on one side, it becomes difficult to make sure there’s enough natural light in that living space. Most of our newer buildings are around 60-65 feet wide, and some of the Factory 52 units were well over 100 feet wide. So you have to add balconies and do other creative things to make sure the space will work for today’s consumers.”

PLK was able to preserve existing infrastructure for 66 historic units, and the remaining buildings are new construction. Factory 52’s first phase included apartments, the Gatherall, the park space, retail space, the leasing office, the preserved Clock Tower, parking structures, a Braxton Brewing taphouse, and the Astroturfed-central greenspace. The developer had to weigh the needs and desires of apartment residents equally with those of nearby existing residents in Norwood. “The idea is creating services your residents want to use but that are also an asset for the community,” says Lingenfelter.

To that end, PLK installed the Bark Park, an Astroturfed public dog park (something Norwood didn’t have) on what Lingenfelter called a “funky-shaped” piece of land that was otherwise not in use. “One of our thoughts was, Hey, Factory 52 has breweries, and lots of breweries allow dogs, so how do we create an amenity for everyone in the area that really becomes this kind of public gathering place?” says Lingenfelter. “It’s a hard problem to solve sometimes. Like, Yeah, what’s in it for the neighbors? Well, typically, a developer is improving a property or taking something that was underutilized and bringing it back to life, and that project then improves all the property values around it.”

PLK purchased the Multi-Color Corp. building next to Factory 52 in 2024, along with a vacant lot on Robertson Avenue. Phase 2 is now underway on the Multi-Color site, with plans for 48 townhomes on the Robertson lot; a final timeline is still to be determined.